Market cap, or market capitalization, is not merely a technical term in the financial world. For many business players, analysts, and investors, market cap serves as the primary entry point to understand how much a company is valued by the market.

Behind the numbers within market cap lies more than just financial data—it also reflects market expectations of a company’s performance and growth prospects. In other words, market cap helps us view a company not just from its revenue or popularity, but from how the market assesses its long-term potential.

In this article, we will discuss what market cap is and why it is important for making strategic decisions regarding investment and business growth.

Definition and Importance of Market Cap

Market cap is the total value of all outstanding shares of a company in the market, calculated by multiplying the current share price by the number of outstanding shares. This figure gives an idea of how large or small a company is in the eyes of the public and the capital market.

Simply put, if someone or an entity wants to buy all the shares of a company, the amount of money needed is reflected in the company’s market capitalization.

Why is this important? Because market cap is often used as an initial indicator to assess a company’s stability, growth potential, and risk profile. Company size generally correlates with its risk-return characteristics, capital structure, and resilience to economic shocks. Investors and business partners see market cap as a benchmark of a company’s strength and position within its industry.

The basic formula for calculating it is:

Market Cap = Share Price × Number of Outstanding Shares

For example, if a company’s share price is Rp5,000 and it has 2 billion outstanding shares, then its market cap is Rp10 trillion. This figure shows that, in aggregate, the market values the company at Rp10 trillion. This value can be used by investors, analysts, or business owners to compare the size of this company with others in the market.

Therefore, market cap is not merely statistical data—it is part of a company’s strategic narrative in the eyes of stakeholders.

Discover More : Cost-Benefit Analysis as the Basis for Decision-Making in Microeconomics and Business to Business (B2B) Projects

Market Cap Categories

In capital market practice, companies are classified based on the size of their market cap. In general, there are three widely recognized main categories:

- Large Cap: Companies with very large market caps, typically dominant players in their industries. They tend to be more stable, have a long-standing track record, and appeal to conservative investors (>USD 10 billion).

- Mid Cap: Medium-sized companies that are often in an active growth phase. They have potential to grow larger but carry higher risks compared to large caps (USD 2–10 billion).

- Small Cap: Companies with small capitalization. Although more volatile, companies in this category are often targeted by aggressive investors due to their higher return potential (USD 300 million–2 billion).

In addition to the three categories above, there are also additional classifications such as micro cap and nano cap:

- Micro Cap: Refers to stocks of companies with a market cap between approximately USD 50 million and USD 300 million. These companies are typically small, possibly newly established, and not yet financially stable.

- Nano Cap: This category falls below micro cap, with a market capitalization under USD 50 million. These stocks are considered highly risky and are often owned by very small companies, some of which may be on the verge of going out of business.

For consultants and investors, this classification serves as the foundation for building strategies in diversification, risk management, and long-term asset allocation.

Factors Influencing Market Cap

Market cap is dynamic and greatly influenced by various factors. Some of the main ones include:

1. Number of Outstanding Shares in the Market

The value of market capitalization can change depending on the total number of shares circulating publicly. In general, the more shares are available in the market, the larger the market cap potential of a company—although this is still affected by the price per share.

In large companies, the release a significant number of shares to the public usually done to raise additional capital, which then used to support expansion or business development. A large volume of high-valued shares that are in demand by investors often reflects a company’s good reputation and high perceived value in the eyes of the market.

PT Bank Central Asia Tbk (BCA), one of the largest private banks in Indonesia, is a good example of how the number of shares outstanding contributes to a company’s high market cap.

As of mid-2024, BCA had more than 123 billion shares circulating in the market. Its stock consistently trades in the range of Rp9,000–Rp10,000 per share. Multiplying the price by the number of shares, BCA’s market cap exceeds Rp1,100 trillion, making it one of the companies with the highest market capitalization on the Indonesia Stock Exchange (IDX).

2. Share Price per Unit

Every traded stock has a specific price that directly affects the company’s total market cap. As with the number of shares, the higher the price per share, the greater the market cap recorded.

Initially, stock prices determined by the company through careful calculation, taking into account asset values, business prospects, and market conditions. However, over time, prices heavily influenced by market dynamics such as demand trends, trading volume, and developments within the company’s industry.

For instance, when PT Unilever Indonesia first went public (IPO), it set an initial price based on its assets and business prospects. Suppose the IPO price was Rp500 per share, and 1 billion shares were released to public, the initial market cap would be:

Rp500 × 1,000,000,000 = Rp500 billion

However, after the stock began trading, its price fluctuated depending on market conditions, company performance, and investor interest. If the share price rose to Rp7,000, the new market cap would be:

Rp7,000 × 1,000,000,000 = Rp7 trillion

This means that even if the number of shares remains the same, an increase in share price can cause the market value of a company to multiply several times. This shows how important stock price movement is in determining a company’s market cap on the exchange.

3. Market Sentiment

Another significant factor affecting market cap is market sentiment. Market sentiment itself shaped by various aspects, ranging from expert analyses and news publications to decisions made by influential figures on national or global scales.

A simple example is when Elon Musk, founder of Tesla, announced Tesla products could no longer be purchased with Bitcoin. The value of Bitcoin dropped sharply following that decision.

4. Company’s Fundamental Performance

A company’s financial performance—such as revenue growth, net profit, and operational efficiency—heavily influences investor perception of the company’s value. Companies with consistent performance and promising growth prospects tend to attract investor interest, which increases demand and drives up share prices, ultimately increasing market cap.

5. External and Macroeconomic Factors

Macroeconomic conditions such as interest rates, inflation, exchange rates, and overall economic growth can affect a company’s market cap.

For instance, rising interest rates can increase a company’s borrowing costs, which may suppress profits and reduce share prices. Additionally, regulatory changes or government policies can impact company performance and, in turn, its market capitalization.

In other words, market cap determined not only by a company’s internal performance but also by how the market collectively assesses the potential and risks associated with that company.

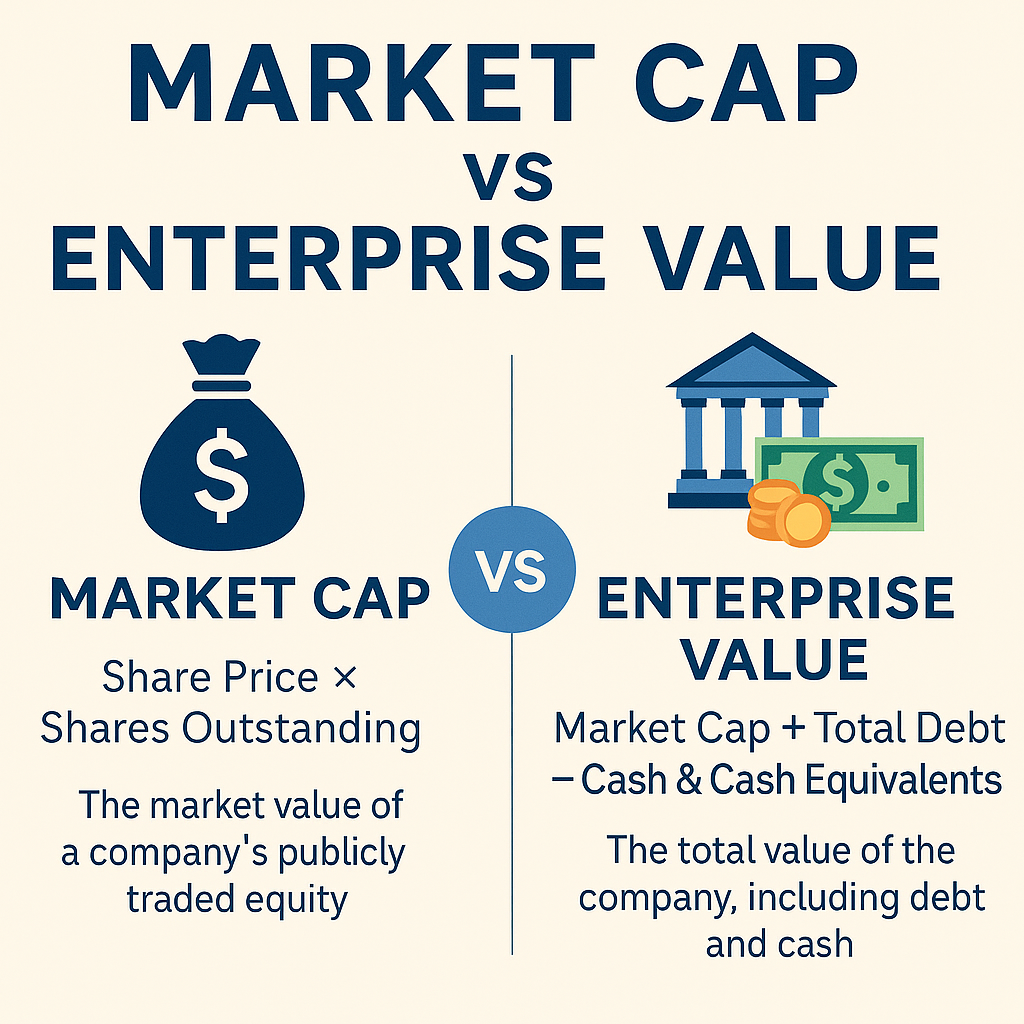

Market Cap vs Enterprise Value: What’s the Difference?

Many people mistakenly believe that market cap represents the full value of a company. However, in more advanced valuation practices, that number only tells part of the story. This is where the concept of Enterprise Value (EV) becomes crucial.

Enterprise Value (EV) is the total value of a company as a whole. EV accounts not only for equity, but also for debt and cash or cash equivalents. EV tells us how much it would actually cost to acquire the entire company, including its financial obligations.

The formula to calculate EV is:

EV = Market Cap + Total Debt – Cash and Cash Equivalents

EV is frequently used in valuation analysis such as peer comparisons, acquisition planning, or in financial ratios like EV/EBITDA and EV/Revenue, which provide a more holistic picture of operational value.

So, What Exactly Differentiates Market Cap from Enterprise Value?

Even though both are used to assess a company, the approach and components they consider are quite different. Let’s break down the distinctions:

1. Components Measured

- Market Cap: Only includes the value of outstanding shares. It reflects how the market values a company based on its stock price.

- EV: Incorporates additional components, such as debt and cash. A company with high debt might have an EV much greater than its market cap. Conversely, if the company has large cash reserves, EV might be lower than market cap.

2. Purpose of Use

- Market Cap: Typically used for quick classification—whether a company is small-cap, mid-cap, or large-cap. Useful for retail investors to assess scale.

- EV: Used to calculate the full economic value of a company in acquisition contexts. In reality, a buyer acquires both the company’s equity and its liabilities—hence, EV is more relevant.

3. Accuracy in Valuation

- Market Cap: Less accurate if a company has an unbalanced financial structure (e.g., high debt or large cash), as it only reflects equity value.

- EV: More representative because it includes financing elements. This is essential in fundamental analysis, providing a more realistic and economic picture of a company’s worth.

4. Relevance in Financial Analysis

- Market Cap: Useful as a general overview for public investors or broad comparisons.

- EV: Applied in advanced financial metrics, such as:

- EV/EBITDA to measure operational performance

- EV/Sales for industries with low profit margins

- A more accurate baseline in mergers and acquisitions

- EV/EBITDA to measure operational performance

5. Investor vs Acquirer Perspective

- Market Cap: More focused on shareholder equity value, hence more suited for public market investors.

- EV: Preferred by financial analysts, private equity firms, or acquirers as it factors in the entire financial picture, including liabilities and liquidity.

Market Cap reflects the market value of a company’s equity, while Enterprise Value (EV) reflects the total cost to purchase the entire company. In the professional world of finance and investment, EV is often regarded as a more accurate and comprehensive valuation metric.

Discover More : The Impact of Fiscal Policy on the Business Sector

Example of the Difference Between Market Cap and Enterprise Value

Market cap only reflects the value of publicly traded shares. However, if someone wants to acquire the entire company, they must also consider the company’s debts and cash holdings. Therefore, Enterprise Value (EV) provides a more complete picture of a company’s true value.

As a real-world example, let’s look at PT Bank Rakyat Indonesia Tbk (BRI), one of the largest companies in Indonesia.

At the time this article was written, BRI’s share price was around Rp5,000 per share, with approximately 150 billion shares outstanding. From this data, BRI’s market cap estimated at around Rp750 trillion. This number often used by public investors as a benchmark for the company’s size and market value.

However, to understand BRI’s full economic value more comprehensively—for instance, in an acquisition or strategic evaluation context—we need to calculate the Enterprise Value.

To do this, we must add the company’s total interest-bearing debt and subtract its cash and cash equivalents. In BRI’s case:

- Total Debt: ~Rp250 trillion

- Cash & Cash Equivalents: ~Rp100 trillion

- Market Cap: ~Rp750 trillion

Then, using the formula:

EV = Rp750T + Rp250T – Rp100T = Rp900 trillion

This comparison shows that even though market cap reflects the value of traded equity, EV captures the real, economic value of the company by factoring in its obligations and cash holdings. This distinction is crucial, especially for consultants and financial analysts, when conducting due diligence, mergers, or acquisitions.

Market Cap in Investment Strategy

In the investment world, market cap is more than just a company size metric—it represents the character and risk profile associated with the company.

For example, companies with large market caps tend to offer stability and predictability. They usually well-established in their industries, generate strong cash flow, and more resilient to economic shocks. As a result, large-cap stocks are often the go-to choice for institutional investors and individuals looking for long-term security.

On the other hand, small- and mid-cap stocks offer high growth potential but tend to be more volatile. These stocks attract investors who are willing to take higher risks in pursuit of greater returns. However, without solid understanding of market cap profiles, investors could misled by seemingly “cheap” valuations or overly optimistic opportunities.

Therefore, market cap is not just a measuring tool, but also an essential guide for constructing a balanced investment strategy—one that aligns potential returns with proper risk management.

In this context, market cap serves as a bridge between fundamental analysis and sound portfolio decisions.

Conclusion

Market capitalization is a key indicator in assessing a company’s market value and competitive position. Not only used to determine company size, but also reflects market expectations of the company’s long-term performance.

For business owners, understanding market cap provides valuable insights into how their company perceived by the market. For investors, market cap helps shape strategies that align with their risk profile and financial goals.

Ready to build a more focused investment strategy? Arghajata Consulting is here to help you deeply understand fundamental indicators like market cap. With data-driven and strategic analysis, we support clients in crafting investment strategies, corporate valuation, and impactful business decisions.